No more moonshots

Why aircraft manufacturers don’t take risks anymore – and why it's even riskier as a result.

The more-for-less world will not let you pursue moonshots.

Go to any airport in America and you’ll see them. Of the approximately 23,000 commercial aircraft in service worldwide, nearly 30% are from this single aircraft family. If you’ve been on the internet in the past 6 months and guessed the first plane that came to mind, congratulations! It’s that plane.

The Boeing 737 — Photo by Boeing

It should be the 8th wonder of the world that a plane with a fuselage straight out of the 1950s is still around. It should be the 9th wonder that it’s the second most popular aircraft family in service. That’s right — not in terms of all-time orders, but in terms of aircraft still flying today.

Of course, these 737s aren’t the same as those from 50 years ago, right? Those 737s looked like this.

Also the Boeing 737, but he original -100 — Photo by Boeing

Look closer. The fuselage, although lengthened and raised, is exactly that — lengthened and raised. It’s fundamentally the same fuselage used on the Boeing 707 and 727, fine aircraft that Boeing had the sense to retire when the time was appropriate. The 737 remains, at heart, a 100-seat hopper designed to sit as low to the ground as possible to allow for boarding through built-in airstairs. It wasn’t built to carry 200 passengers across the Atlantic, but that’s exactly what Boeing did with the MAX.

It’s like putting a V8 in a Smart Car and then stretching it. You should probably just buy a different car.

If you don’t really care about aviation (first, thanks for reading this because I probably sent you the link), this derivative-mania still affects you. Trading technological advancement for safe profits does more harm than good. This article examines why aircraft design is risky, but also why it’s more dangerous to avoid taking risks.

What are moonshots? And why did we take them?

Moonshots are risky, ground-breaking projects with unparalleled upside.

Here, moonshot refers to brand new, “clean-sheet” commercial aircraft designs. (This might not seem audacious yet, but give me 5 more minutes to convince you)

If you’re looking for examples of these moonshots, start with Boeing’s Wikipedia page. Despite everything I said about the 737’s excessive offspring, no other manufacturer has bet so much so often — and lived to tell the tale.

The Dash 80 — just one of Boeing’s many moonshots.

From a legendary gamble on jet engine technology with the Dash 80 — the precursor to the 707 — to the simultaneous design of the 747 Jumbo Jet and the supersonic 2707 that literally left the company $1 billion in debt, late 20th-century Boeing decided that flying too close to the sun wasn’t cool enough, so they flew right through it. Multiple times.

What might be more impressive, however, is that Boeing wasn’t alone. Everybody was pumping out clean sheet commercial jets, partly because manufacturers simply didn’t have existing designs to create derivatives from.

The result was permutation heaven. Almost every engine and wing combination was tried out on a drawing board somewhere.

Concorde.

Equally salient was the incredible amount of demand. Airlines were asking for more; more speed, capacity, and floors(?). A key name to remember is Juan Trippe, Pan American Airways’ iron-fisted leader who managed to repeatedly strong-arm Douglas, Boeing, and the U.S. government into producing the planes he wanted.

It’s difficult to overstate Trippe’s influence in shaping the civil aviation market. Ignoring his requests was unwise, and the easiest way to meet his demands was often to build a new plane from scratch. For example, a stretched Boeing 707 would never meet Pan Am’s specifications for a 400-seat intercontinental transport, but a clean-sheet design could.

The result? The world’s first jumbo jet and widebody commercial aircraft (2 aisles instead of 1).

The original Boeing 747 being rolled out in 1968 — Photo by Boeing

Perhaps most importantly, and the least straightforward to explain, are the decisions of powerful individuals. Nobody can definitively pinpoint why Boeing President Bill Allen decided to bet the entire company on what was essentially a proof-of-concept airplane, the Dash 80. Nobody knows why Lockheed, another American manufacturer, pushed ahead with the clean-sheet Tristar despite a crowded market and strong competitors.

The Lockheed L-1011 Tristar, an extremely advanced clean-sheet that found few customers.

However, this uncertainty certainly won’t stop me from speculating.

Boeing wasn’t a public company when the 707 was launched, their previous United Aircraft and Transport conglomerate carved up by antitrust laws some 20 years prior. Management may therefore have felt less beholden to their share price and been more open to risks.

The competitive environment can’t be ignored either. Boeing didn’t offer a viable competitor to piston-powered stalwarts like the Douglas DC-4, putting them in a unique, almost nothing-to-lose situation.

Finally, pressure for innovation also came from overseas. The sight of de Havilland’s jet-powered Comet at the 1952 Farnborough Air Show reportedly tipped the scales for Allen, and he promptly emptied Boeing’s war chest on his own jet design upon returning to the U.S.. The American government certainly supported the efforts, as further inaction would effectively mean ceding technological leadership to the British.

For Lockheed, the Tristar was just one of many — financially unsuccessful — attempts to capture the civil aviation market. The venerable Constellation and P-3 Orion were 2 other attempts that made Lockheed synonymous with innovation and financial success, but only after being pressed into military service. Perhaps the profits derived from these programs, in no doubt aided by the pursuit of global U.S. hegemony, gave Lockheed the confidence to pursue the Tristar.

These 2 examples serve to illustrate how factors like competition, curiosity, and even Cold War patriotism shaped the market that encouraged clean-sheet designs.

No single reason can fully explain the moonshot mania that gripped commercial aviation in the 20th century. But some elements stand out:

- Prior technology didn’t exist, so everything seemed like a “moonshot”

- Airline demand for new capabilities necessitated new designs

- For whatever reason, be it patriotism or the spirit of competition, leadership encouraged moonshots

Why is aircraft design so risky?

What makes them “moonshots”?

With commercial aircraft, there are generally 2 things that can go wrong:

- Your plane doesn’t work. It either doesn’t do what you said it would do, or it doesn’t do it well enough (e.g. Convair Coronado).

- You run out of money (also e.g. Convair Coronado).

You guessed it, the Convair Coronado.

When you think about it, having a plane not work (Point 1) isn’t that serious if you have the resources to fix it (Point 2). But this isn’t always an option. Not only do you need to spend money fixing the actual plane, you also need to compensate the airlines and organisations that were expecting a functioning product at a certain date.

Of course, a big reason for committing to a delivery schedule is the assurance that someone will actually buy planes that — using the A350 as an example — cost north of $300 million each.

To illustrate the capital-intensive — and therefore risky — nature of clean-sheet aircraft design, let’s look at the Boeing 787.

The 787, Boeing’s last clean-sheet for a while — Photo by Ethan McArthur on Unsplash

With an estimated development cost of around $15 billion, one might be tempted to say:

Using a generous revenue estimate of $200 million per airframe (due to discounts typically handed out to airlines) a healthy 25% profit margin translates into $50 million in profit per plane. This means it would take 300 aircraft to recoup all development costs ($50 million x 300 = $15 billion).

Given that forecasts from 2003, when the 787 was being designed, showed a future market size of 2000–3000 mid-sized widebodies, the 787 seemed like a surefire lock to eventually be a flying ATM.

Except, and this is a big except, the first few hundred 787s don’t actually have 25% profit margins. They aren’t anywhere close. Boeing lost money on 787s from 2011 to 2016, in the process racking up $30 billion in “deferred costs”.

Deferred costs are a form of accounting gymnastics that allow you to record current costs as future expenses. Companies defer costs for many reasons; one reason is to better reflect an upfront cost that expenses over time, such as R&D. Instead of charging all your R&D to your first few products, and making shareholders think that you’re losing $60 million on each plane, deferred costs spread your expenses out over a projected 1,400 planes (an accounting “block”). Given that R&D benefits every unit produced, it arguably also increases accounting accuracy.

Boeing does exactly this. They defer the losses from the first few (hundred) aircraft, arguing that the knowledge gained from initial deliveries helps them spend less on producing future planes. As such, initial losses aren’t losses at all, but instead constitute de-facto development costs.

This is true to some extent, but it’s also incredibly difficult to quantify this “learning curve”. Regardless, Boeing has to deplete $30billion of deferred costs and pay off $15 billion of development costs before the 787 program is truly profitable. A reduction in deferred costs began in 2016, when 787s finally began costing less to make than sell.

Still, many believe that Boeing has dug too deep a hole for the 787 to fly out of. The exact numbers vary, but even if each plane now makes an incredible $50 million in profit, there may be insufficient demand to recoup the remaining $30 + $15 billion.

This gargantuan financial risk (Point 2 above) isn’t to discount the technical aspect of aircraft design (Point 1).

Part of the 787’s $30 billion pickle includes costs stemming from some, to use a technical term, screw-ups. Extensive use of lithium ion batteries and plastic composites were supposed to usher in a lighter, cheaper era of aviation. And they have — it only took years of delays, two electrical fires, an FAA grounding, and over $10 billion extra to get there.

One of the 787’s multiple spontaneous fires — Photo by CNN

I’m not dumping on Boeing by outlining the momentous delays suffered by the 787. I’m arguing that no amount of computer modelling or full-scale testing can completely eliminate risk. Not that it should — risk complements reward, and the 787’s struggles have given way to an aircraft beloved by crew and passengers alike. We’re just don’t know if the accounting department will ever feel the same way.

With multi-billion dollar budgets and the omnipresent risk of technical failure, it’s safe to say that clean-sheet aircraft are moonshots, even if they stay within the atmosphere.

Why we’re not pursuing moonshots

“Very often in aerospace the challenge is not technological, but financial or operational,” — Rolf Henke, German Aerospace Research Institute.

Airlines aren’t demanding clean-sheet designs from manufacturers.

This over-simplifies but sums up the situation. Commercial aviation has changed substantially since the try-anything-and-everything days of the 1960s, and most changes can be explained by one law:

The 1978 Airline Deregulation Act.

Yes, this was an American law, but America’s aviation dominance effectively made it a global decree. I’ll outline the before and after scenarios.

Before deregulation, the majority of the world’s major airlines were government-owned or -subsidised “flag carriers”. Airlines in the U.S. were a notable exception, but the entire industry was heavily regulated in efforts to prevent excessive competition. An element of public safety was involved; some feared that a cost-cutting race to the bottom would lead to dangerous shortcuts in maintenance and operations.

Profitability took a backseat in a world where harsh competition was held at bay and governments effectively guaranteed bottom lines. With prestige — and often national pride — on the line, major airlines naturally sought to fill their fleets with the newest toys. This meant having planes that pushed the envelope with size, speed, or — for the fun of it — both.

Things are now different after deregulation.

Increased competition forced traditional airlines to overhaul their management strategies in favour of efficiency and productivity.

The low-cost-carrier (LCC) can be partially thanked for this. Their proliferation of cheap, no-frills services uprooted a stale and complacent marketplace, forcing legacy carriers to adapt or die. Many did both.

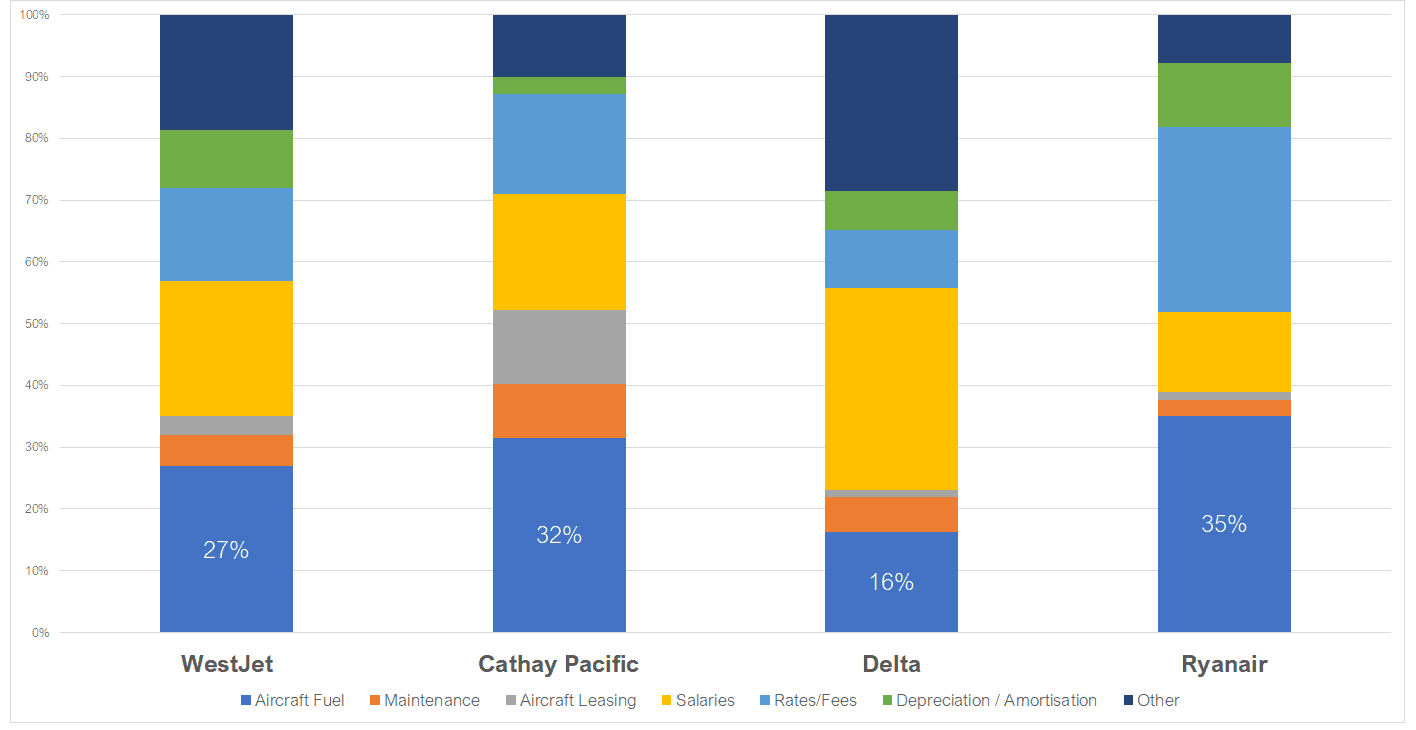

For the survivors, cost-cutting became a way of life. A quick look at the operating expenses of several airlines reveals how this could be undertaken.

2018 — Operating Expenses of WestJet (Canada), Cathay Pacific (Hong Kong — Flag Carrier), Delta (US), Ryanair (European — LCC)

Unsurprisingly, planes represent a significant portion of airlines’ operating expenses; this involves fuel, maintenance, leasing, and depreciation.

Keep in mind that these operating expenses don’t reflect the initial purchase cost of the actual aircraft. With the cheapest 737s and A320s starting at $100 million, and widebodies like the Airbus A350 costing at least $300 million, aircraft orders easily run into the billions.

Fuel and purchase costs therefore constitute the two easiest targets for fat-trimming measures. The conclusion is painfully simple:

Airlines want cheaper planes that burn less fuel.

Moonshots just aren’t compatible with this vision. They’re the opposite of cheap.

Clean-sheet designs are arguably the only way to achieve long term efficiency improvements, but airlines can’t ignore the immediate costs. Moonshots are incredibly expensive to develop. They also take time, a precious resource that many airlines can’t afford to spend.

The alternative is playing out in front of our eyes. Derivatives — updated versions of older models — are cheaper and quicker to bring to market.

The 737 MAX cost Boeing around $4 billion to develop from previous models, compared to the estimated $10-$12 billion it would take to field a clean-sheet replacement. In another example, the 787 wing will be scaled up and recycled for the new 777X (see infographic below). These savings can dramatically reduce the purchase cost of aircraft, satisfying airline demands in the interim.

Boeing released an infographic explicitly outlining this recycling

Manufacturers are happy to comply, as the derivative game offers safe profits with fewer risks. Harvesting the technological gains from prior moonshots also makes sense — if airlines are buying, then why push it?

There’s one final reason that I’ll touch upon. For all the changes within the airline industry, the manufacturing side has undergone a similarly dramatic shift — the field has shrunk to two players: Boeing and Airbus.

An airline like Pan Am can no longer pit three American manufacturers against each other. Only Boeing remains, with Douglas and Lockheed exciting the commercial market after several expensive failures. In Europe, the manufacturers of Britain, France, Germany, and others have coalesced into the Airbus behemoth.

The duo now combine for 90% of the global commercial aviation business. While competition between the two is fiercer than ever, both companies have realised a critical truth of oligopoly: if the other doesn’t do anything, you don’t have to either.

Airbus and Boeing both understand the immense risks with bringing clean-sheets to market. They also understand that as long as neither of them actually do, they can fall back on releasing derivatives of their extremely successful A320 and 737 lines. With their respective positions on the global industrial stage guaranteed by mutual inaction, the rewards of moonshots simply aren’t commensurate with the risks.

To summarise, airlines want cheaper planes, and the world’s two remaining manufacturers are in implicit agreement to offer derivatives, not moonshots, as the solution. This section only begins to explain the esoteric reasons behind this conclusion, leaving further exploration up to you, the reader.

Why it’s dangerous to avoid moonshots

One of the answers to why it’s dangerous to avoid moonshots

This section almost wrote itself. The motivation for this article came from the second 737 MAX crash, a tragedy largely caused by Boeing’s “no more moonshot” mentality.

Recall that Airbus and Boeing are a textbook duopoly. If the opposition becomes complacent, you can follow suit. Conversely, if the other company does something, you’d better have a response for it, and quick.

In 2011, Boeing found themselves in the second situation. Long-time customer American Airlines broke their Boeing fleet homogeneity by ordering 260 Airbus A320 NEOs alongside 200 Boeing 737s. 100 of these 737s were to be a re-engined version of the most advanced 737 at the time, the 737NG.

The catch? A re-engined 737NG didn’t exist. American Airlines publicly announced their intention to buy a plane that Boeing hadn’t even agreed to make. Boeing had rudimentary plans for such an aircraft, but were publicly known to be leaning towards a clean-sheet replacement for the entire 737 family. The original 737 was already a 40-year old design at that point.

The American Airlines announcement forced Boeing’s hand. Coupled with the success of Airbus’ A320 NEO, NEO standing for New Engine Option — another derivative, Boeing opted for the safe route. Instead of a clean-sheet replacement, there would be yet another 737 derivative.

Within months, the 737 MAX was announced. This plane would have ludicrous specifications for a 737, flying more than 150 passengers over distances approaching 4,000 nautical miles. With loyal customers lined up for the MAX, the prospect of sinking over $10 billion into an unknown clean-sheet seemed even less attractive to Boeing.

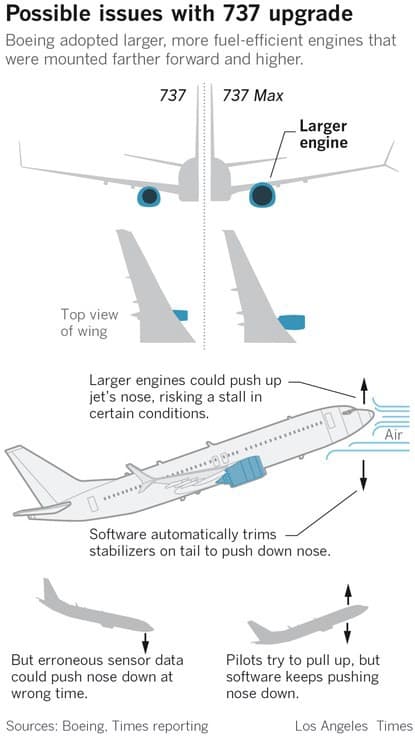

In hindsight, this decision was far from safe. Achieving the advertised 10%+ fuel consumption improvements required newer, larger engines. You’ve probably heard the following explanation.

(Keep in mind that the original 737 was designed in the 1950s to sit as low to the ground as possible in order to use built-in airstairs)

In short, Boeing placed the engines higher and further forward in order to maintain adequate ground clearance.

This engine placement altered the MAX’s centre of thrust, causing the plane’s nose to pitch up dangerously at low speeds with high thrust settings. These conditions happen to be satisfied on every flight, during takeoff.

Boeing’s solution? The now infamous MCAS, a piece of software designed to push the MAX’s nose down if it detected excessive upwards pitch. This single point of failure was uncharacteristic for Boeing, the same company that installed 4 hydraulic systems in the 747 for safety purposes.

Boeing pushed the original 737 design too far. The desire to avoid a clean-sheet replacement is perhaps understandable, but selling a compromised aircraft was downright irresponsible. Boeing has already taken a $4.9 billion charge with more guaranteed to come, cancelling out much of the savings from avoiding a clean-sheet replacement.

With the MAX still grounded at the time of writing, it remains to be seen whether this 50-year old design can be rescued one final time. And that quote from the start of the article? The one about not pursuing moonshots? That was Jim McNerney, President and CEO of Boeing from 2005 to 2015.

References

- 747: Creating the World’s First Jumbo Jet and Other Adventures from a Life in Aviation — Joe Sutter, Jay Spenser

- Birds of Prey: Boeing vs. Airbus — Matthew Lynn

- Beyond the Horizons: The Lockheed Story — Walter J. Boyne

- Flight Path: How WestJet Is Flying High in Canada’s Most Turbulent Industry — Paul Grescoe

- The Global Airline Industry (Textbook) — Cynthia Barnhart, Amedeo Odoni, Peter Belobaba

- Online References