What’s next for Porter Airlines?

Every airline has been through hell. Exploring 3 post-COVID challenges for Toronto's own Porter.

Just one day after we published Porter Airlines’ sneaky strategy, the airline announced that flight resumptions would be pushed back to June 21st (now September 8th). I can therefore proudly proclaim that we’ve achieved our goal of publishing this follow-up before Porter returns, admittedly not the tallest of tasks.

In that article – which you should definitely read – we explored how Porter created their enviable market position using a Blue Ocean Strategy; they raised the passenger experience by delivering premium service, created convenience through Billy Bishop, and reduced complexity by streamlining their fleet and route network.

We’re not making it through an article about Porter without this picture appearing at least once

However, we left off by discussing some looming challenges for Porter. Some concerns precede the pandemic and are inherently tied to the carrier’s strategy, an example being the natural limitations of exclusively operating Q400s out of YTZ. Other issues are closely linked to the unique circumstances of COVID, such as an increased debt load.

This article explores 3 key obstacles that Porter must address going forward:

- Saturation of their network

- Increased competition

- Financial effects of COVID

We originally wanted to answer the question: “Will Porter survive the pandemic?”, but reaching a conclusive yes/no is likely beyond our capabilities (and someone would probably pay for it). Instead, this article aims to increase understanding of the dangers the carrier must contend with, giving you the necessary context to make that judgement.

The saviour is here – Photo by Porter

1. Saturation of their network

Few will argue that Porter’s growth has stagnated. The carrier increased their destination count by 7 from 2010 to 2013, but have a net increase of just 3 since then.

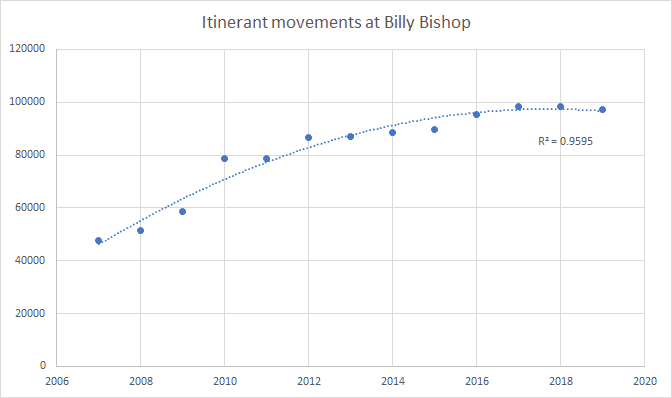

Itinerant movements at Billy Bishop have also flattened out since 2014; as the dominant commercial operator at the airport, Porter’s activities likely influence this trend heavily.

There are several key reasons for this evident slowdown:

Supply-side: No more slots

Most airports only permit a certain number of aircraft movements, and Billy Bishop’s 202 daily slots are largely taken. Porter/Air Canada have been fully utilising them on weekdays since 2014, and weekend usage has likely reached the maximum since then.

Slots can be reassigned, but the maximum number isn’t increasing anytime soon – opposition to any airport-related growth will ensure that. All else being equal, this turns network growth into a zero-sum game; introducing regular service to a new destination will come at the expense of an existing one, for example.

Porter has managed to increase their own slots by scaring off Air Canada

Supply-side: Range and capacity limits of the Dash 8

Porter already operates the Dash 8, the largest and longest-range aircraft approved for regular service at Billy Bishop. Even then, the airport’s short runway prevents Porter from loading aircraft to their maximum takeoff weight; that would require ~1,500m of runway, far in excess of the available 1,216m.

This really is the perfect plane for Porter (bonus points for being Canadian)

Not only does this limit the number of passengers that can be flown on a single flight, but the aircraft’s maximum range is also compromised. Porter therefore can’t grow by simply flying larger aircraft to farther destinations, to say nothing of the demand-side complications that we’ll discuss in the next section.

Structural improvements, such as runway lengthening or jet approval, are unlikely to come soon – if ever. As I wrote in our previous article:

Between community opposition and environmental concerns, I’m half surprised that the airport still exists.

ok why is this a stock photo?

Porter will have to get creative with the Dash 8’s limitations. A new connecting hub could be established away from Billy Bishop, for example, maintaining a convenience advantage whilst opening up new destinations.

Demand-side: All viable destinations reached

Put simply, Porter already serves most of the viable destinations within the Dash 8’s range from Billy Bishop. This isn’t some radical insight; the idea has been floated for over half a decade. No easy growth markets remain, especially with the carrier’s focus on business travellers or those willing to pay for convenience.

Demand-side: Market already served

Simply increasing the volume of available seats, whether through a higher flight frequency or more destinations, won’t necessarily translate into growth.

Porter’s load factor is accepted to top out in the 70% range, a profitable level thanks to the Dash 8 but far short of indicating a supply-side restriction. Coupled with the previous point about all feasible destinations being served, Porter may have already captured most of their total addressable market.

What slow growth means

Porter might have to disrupt a fundamental part of their business. They’ve squeezed incredible value out of their existing operating model, but the carrier needs to grow in order to stay abreast of competition and face rising costs.

Addressing any of the aforementioned limitations would require a seismic shift for Porter. The issues of slots and Dash 8 restrictions are tied to Billy Bishop; fixing these would require moving away from the airport. Tackling destination and market saturation either means expanding geographic reach or targeting a new customer segment, uprooting major parts of their existing strategy.

Yet it seems like COVID has forced their hand. The Globe and Mail reported last month that Porter recently approached Toronto Pearson to discuss establishing jet operations, coinciding with multiple reports that the carrier has “signed a firm order for 30 E195-E2 jets with an undisclosed customer, with deliveries starting in 2022”.

These actions could be the boldest step for a company seemingly impervious to risk. Don’t forget that they had no qualms about pouring over $50 million into a derelict airport, evicting the national carrier, then flipping the terminal for a 1200% return. Establishing regular jet operations away from Billy Bishop would strike at the heart of their issues surrounding network saturation, opening up hitherto impossible options.

2. Increased competition

Airlines may have gone into hibernation during the pandemic, but just like the natural world, not everyone sleeps. (on second thought, this isn’t that great of a metaphor, but I’m keeping it in here)

Between new and existing competitors, Porter might find themselves returning to busier airspace, especially in areas where they may have previously been dominant.

The most blatant challenge comes from Connect Airlines, an upstart backed by Massachusetts-based charter operator Waltzing Matilda Aviation.

The airline intends to use Flybe’s fire-sale Q400s to link Billy Bishop with nearby US destinations, namely New York, Boston, Philadelphia, Chicago, and Baltimore, which means they’re only missing Tampa Bay to round out the American League East.

Fortunately for Porter, Connect may not initially appear to be a large threat. They claim to be offering “a premium service for day-tripping business travelers” that “complement[s] the destinations that Porter Airlines was serving prior to COVID-19”.

Porter still also holds a stranglehold on ~85% of slots at Billy Bishop and has never shied away from protecting them, giving Connect a veritable uphill battle to secure space at the airport.

However, Connect has two characteristics that should concern Porter. First, they’re entering with a clean balance sheet, free from financial obligations that will hamstring Porter for the foreseeable future; more on this in the following section.

Second, Connect will only exacerbate the network saturation issues faced by Porter. The former might be more proportionally focused on US destinations, but both networks overlap extensively. Connect CEO John Thomas claims that Billy Bishop “never captured its fair share of the transborder market” before the pandemic, but it remains to be seen whether sufficient demand will exist to pick up the additional supply.

Other competitors have been more subtle, such as PAL airlines. Noticing the severe pullback in service from WestJet, Air Canada, and to some extent Porter, PAL – a regional operator based in Eastern Canada – stepped in to fill the void. They added multiple routes in 2020 and have continued to do so in 2021, announcing an expansion into 11 new cities in April.

Impressive for any time, let alone a pandemic

Porter didn’t have a huge East Coast focus prior to the pandemic and will still have strength in connecting Toronto with the east coast. However, routes like Halifax – St Johns might be more competitive than before the shutdown, further constraining Porter and perhaps changing their focus.

3. Financial effects of COVID

How do you run a business with no revenue? That’s the predicament that most airlines found themselves in when the pandemic hit. In certain countries, carriers have resumed limited services and taken substantial government assistance.

There will be little relief in Canada.

For better or worse, our airlines have largely been left to go it alone. Porter recognised this and made the bold decision to suspend operations on March 18th, 2020 – coinciding with stricter travel restrictions and coming just several days into the first lockdown.

Stubborn operating costs

The lack of flying doesn’t mean that costs suddenly go to zero. Some estimate that 25% of airlines’ total operating costs “are fixed in the context of the entire fleet being grounded.”

Porter doesn’t release financial data, so we’ll get creative and use Allegiant – the American ULCC – as a very rough reference. Given that Porter has a fleet of 29 compared to Allegiant’s 111 aircraft, we’ll assume that Porter’s costs are a quarter of Allegiant’s; this is likely an underestimate due to the latter’s ULCC structure and the high cost of operating in Canada.

This might be a stretch comparison, but hey – it’s still a comparison

Allegiant was burning through an average of USD $900k every day during the second quarter of 2020; using our very scientific method of dividing by four, Porter’s burn comes out to approximately CAD $270k / day.

It’s difficult to ascertain the exact financial runway that Porter has, but IATA chief economist Brian Pearce commented early last year that “more than 75% of airlines we looked at actually had less than three months of cash and equivalents to cover those costs.”

In any case, the carrier took out a new $135m loan at the start of the pandemic. Porter spokesman Brad Cicero described it as “a loan similar to other arrangements previously made with EDC” (Export Development Canada).

One of the carrier’s prominent loans with EDC was for $250m at an average interest rate of 4.92%, maturing after approximately 15 years. Applying this logic to the new $135m, Porter would need to repay ~$15m a year until 2035. That equates to over 6% of Porter’s estimated pre-pandemic annual revenue.

Using our prior cash burn estimates, this $135m lengthens Porter’s runway by 500 days. Combined with an existing 3 month buffer, the carrier could be financially secure until the end of 2021.

While these loan conditions aren’t suffocating by any means, the additional commitment will hamper Porter’s flexibility exiting the pandemic. This loan must be repaid alongside existing obligations, compromising the resources available to grow their network or fight off competition – as described in the previous sections.

Revenue implications

The other side of these financial effects are the likely challenges on the revenue side. Porter’s target market primarily comprises 2 demographics: business travellers and premium leisure travellers, the latter being those who are willing to pay for the convenience of Billy Bishop or fly to destinations like Mont Treblant.

The business portion of this ridership should be the most concerning, especially when the short flights mean that many passengers were previously of the day-tripping kind – exactly the type of business travel now made somewhat redundant by Zoom and Teams.

Revenue from leisure travel will likely also be compromised until more certainty arrives surrounding border restrictions with the US. Both governments have unveiled arcane restrictions based on vaccination and citizenship status, and a fresh border shutdown isn’t unprecedented either.

Until there’s some stability on that front, Porter can’t rely too heavily on cross-border revenues.

Combined, stubbornly high costs and depressed revenues don’t bode well for profitability, only adding to the challenges that Porter must contend with coming out of the pandemic.

Conclusion

We’ve covered 3 broad challenges that Porter has to contend with going forward, some of which strike directly at the core of their strategy.

Does this mean that they’re done? Absolutely not. Porter has repeatedly defied the odds, proving their detractors wrong time and time again. Remember, they were never supposed to survive, let alone succeed. They can’t be counted out.

Nobody knows for certain how Porter’s future will shake out, but we get the privilege of seeing it unfold in real time.